|

Advance:

|  |

| INFORMATION: |

|

|

|

|

COMPONENTS: |

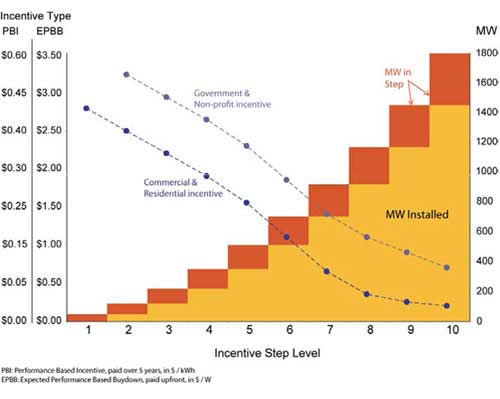

Solar Power and Wind Energy System IncentivesThe Go Solar California website has all the information you need. Including paperwork for buydown program applications. New Residential Construction Starting January 1, 2007 the California Energy Commission will rebate $2.50 per rated watt on NEW Residential Construction that includes a Solar Utility Interface System. This program, called the New Solar Homes Partnership requires builders to incorporate levels of Energy Efficiency higher than Title 24 Standards and requires using high performance components approved by the CEC. There are also restrictions on orientation, tilt and shading to receive the maximum $2.50 per watt incentive. The incentive is determined using the NSHP PV Calculator and will be reserved for you at that amount once your application is approved. Later, it will be verified by a field test. This program is called Expected Performance Based Incentive (EPBI) and the incentive amount reduces as installed mW triggers are reached. Commercial and Existing Residential Commercial and Existing Residential Systems less than 30kW initially will receive a similar, one time, up front incentive based on expected system performance. Expected performance must be equal or less than the power used in the previous 12 months and will be calculated based on equipment ratings and installation factors, such as geographic location, tilt and shading. This incentive structure is called Expected Performance Based Buydown, or EPBB. This rebate will be administered by the California Public Utility Commission thru your Electric Service Provider. Residential and commercial rebates are currently $1.10 per watt PG&E customers. Systems greater than 30kW in size will be paid monthly by the CPUC based on the amount of energy that they actually produce for their own use plus the power that is sent to the grid. This Performance Based Incentive (PBI) is currently set at $0.15 per kWh on new applications for Commercial and Residential Systems. These are PG&E figures. The PBI rate lasts for five years from the date that the reservation is approved (not when you start producing power). It is fixed at the original amount and includes both the power you provide for yourself and the power you send to the utility grid. The current PBI pay back will be reduced as will the EPBB upfront incentive as the total number of reservations for solar electric grid tie interface systems hit MW trigger points. These MW - triggers will reduce the incentive in steps until 350 MW are in place or reserved. Systems smaller than 50kW may choose the PBI method if they wish to spread the Federal Tax over 5 years. Incentives amounts paid, approved and pending statewide can be found at the CSI Trigger Tracker website which is updated daily.

A licensed California Contractor or the owner may do the installation whichever plan you use. For more information go to the Go Solar California website. PG&E also has a a good web page. The first step is to send an application to your Utility (PG&E or SCE) including the size of the System and the expected power output. Use the CSI Calculator to estimate your rebate. If approved, your incentive is reserved until the System is installed and verified. For all PBI Systems a separate System Performance Meter (+/-2%)must be installed to display and record the energy production and a Performance Monitoring and Recording Service must be employed for five years by the owner. EPBB Systems can usually use their Inverter Meter (+/-5% accuracy) and, if the cost of the PMRS and Meter comes to more than 1% of the System's installed cost, they are exempt from the PMRS requirement(0.5% if over 30kW). Once the application is approved, the funds will be reserved for approximately 60-90 days by which time you must provide adequate proof of progress towards installing your system. Your system does not have to be installed within this period, but the utility will require you to provide documentation to prove you are serious about moving forward with the project. When your system is installed, you or your installer will contact the utility for permission to connect your system to the utility grid. Once your system is connected, you also must provide proof of payment and copies of warrantees to the program administrator to receive your rebate. EPBB Systems will be field checked to verify the energy output. PBI Systems will be paid monthly on the actual kWh produced from the PMRS data.(The 5 year PBI monthly payments start at the approval date not the connection date). Advance can help you with your paperwork. Advance Power's crews work under our C-46(solar) and C-10(electrical) licenses. A list of qualifying components can be found at the Go Solar Eligible Equipment Webpage. The Energy Commission and PUC have also approved utility interface/backup system rebates. Same as above - $2.50 max per watt for new Residential, $1.10 per watt for existing Residential and Commercial Systems up to 50kW (EPBB), or $0.15 per kWh produced monthly for larger systems under PBI. You can also get credit on you Utility Bill for power you send to the grid. Net Metering allows you to send the excess power you produce back to your Electric Service Provider and get credit against your utility bill. These credits are generated by the retail price of the energy at the time you produce it, and your yearly bill will be based on the difference between the value of the electricity generated vs the value of the energy used over that year. You cannot at this time receive credit for excess production value at the yearly "true up", or carry it over to the next year. Another option is Time Of Use (TOU). This plan gives you credit at a much higher rate per kWh during the day and charges you a lower amount for the power you use in the evening. These systems will be smaller because the utility does not credit excess power and it is the value of the power sent to the grid that is compared with the value of the power you use from the grid not the kWh.

CALIFORNIA WIND POWER INCENTIVES:

FEDERAL SOLAR and WIND INCENTIVES:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ADVANCE POWER INSTALLED COST: ($7.00 per PTC-AC Rated Watt) | $16,492.00 | |||||

| System Rebate from CSI Calculator: ($1.10/Watt for this System) | -$2,456.00 | |||||

| INSTALLED COST AFTER REBATE: | $14,036.00 | |||||

| Federal Tax on Rebate: (15%) | +$368.00 | |||||

| 30% Federal Income Tax Credit: | -$4,948.00 | |||||

| TOTAL SYSTEM COST AFTER TAX CREDIT: | $9,456.00 | |||||

This system's net installed cost after Rebate and Tax Credit is $4.01 per PTC watt.

EXAMPLE (2) A Commercial 46.6 kW System

(CEC-PTC-AC Rating), 75,067 kWh per year,

located in Redwood Valley, Ca. with optimal tilt and

orientation:

| ADVANCE POWER INSTALLED COST: ($7.00 per PTC-AC Rated Watt) | $326,200.00 | |||||

| CSI Calculator PBI 5 year Rebate: ($0.15 per kWh) | -$56,300.00 | |||||

| NET COST AFTER REBATE: | $269,900.00 | |||||

| Federal Grant 30% of System Cost:(1) | -$97,860.00 | |||||

| NET COST AFTER 30% GRANT:($3.69 per Watt) | $172,040.00 | |||||

| Five Year Federal Accelerated Depreciation Savings:(2) | -$94,272.00 | |||||

| State Depreciation Savings:(3) | -$21,203.00 | |||||

| NET TOTAL SYSTEM COST AFTER 5 YEARS: ($1.21 per Watt) | $56,565.00 | |||||

The Net Cost does not include the savings from the power produced and used by the business.

(1) Calculated as 30% of the Total System Installed Cost.

(2) Calculated as follows: Total Installed System Cost - 1/2 the Federal Grant credit x Federal Income Tax rate (34%). Assumes non-corporate business taxpayer using MACRS.

(3) Calculated as follows: Total Installed System Cost x State Tax rate (6.5%).

Final costs may vary with each individual's situation and should be determined with the assistance of a qualified tax professional. This example is not to be used as a template. Please visit the IRS Website, the Franchise Tax Board or download the Seia Tax Manual for more information. Again, we strongly urge you to contact your tax professional before proceeding.

If you are planning to include a backup system, the cost of backup components and installation must be subtracted from the total System Cost before the tax credit is calculated. Off Grid Systems producing electricity for a residence or business do qualify for the Federal Tax Credit, but not for the CEC rebate.

1-888-228-9694 or 707-485-0588 or E-Mail Us

| TOP | HOME | ORDER |